Office No. 106A, B-Wing Kanakia Wall Street,

Andheri - Kurla Rd, Chakala, Andheri East,

Mumbai, Maharashtra - 400093

Angel Funds provide capital for business startups,

usually in exchange for convertible debt

or

ownership equity. Angel Funds typically involve

higher risk but offer the potential

for substantial

returns if the startups succeed.

Investing in Angel Funds allows you to be part of

groundbreaking innovations and

entrepreneurial

journeys. It's an opportunity to diversify your

portfolio with

investments that have the potential

for high returns. By investing in startups, you not

only support new businesses but also position

yourself to benefit from their success.

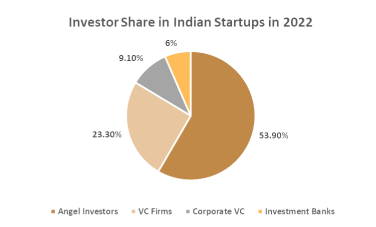

Angel investors held the largest share at 53.9%, followed by venture capital firms, Corporate VC funds, and investment banks.

Source: Inc42

Angel funds are a type of venture capital fund that focuses on providing the much-needed capital to high-growth potential startups during their early development stages, when traditional sources of financing may not be available. Angel funds play an important role in strengthening the startup ecosystem by supporting them and helping them to develop into successful businesses.

An ‘Angel Investor’ is usually a high-net worth individual who provides funds for start-ups or entrepreneurs in exchange for ownership equity in the company. It can either be a one-time investment, or consistent financial support through the struggling years of the start-up.

For many small companies, without financial backing, angel investing is the only primary source of investment that works. In addition to providing funding, angel funds also offer startups valuable resources such as management mentoring, guidance, and industry contacts that can help them grow and succeed.

Although they both give money to start-up businesses, venture capitalists are usually experienced investors who make large portfolio investments in a variety of new businesses, offer practical advice, and use professional connections to support the budding company.

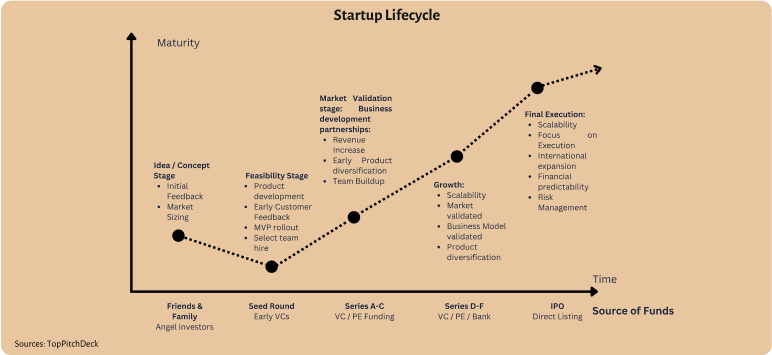

Conversely, angel investors are typically affluent people who like to invest in start-ups more as an interest or side activity and might not offer the same level of specialized advice. Additionally, venture capitalists typically follow angel investors in terms of investment timing. While angel investors offer crucial support throughout the early phases of a business, venture capital funds concentrate on investing in later stages of the enterprise.

As per SEBI regulations, angel investor can be anyone who wants to invest in an angel fund and fulfils one of the following conditions:

An angel investor need to invest a minimum of 25 lakhs INR over five years in the startups he/she likes, through the Angel Fund.

The points where the two categories differ are as follows:

Under AIF Regulations, Angel Funds can be set up and they have following key features:

The category I AIF are given pass-through status, whereby the responsibility for taxation shifts from the fund to the individual investor, even if the investor hasn't redeemed their investment. Investors are required to pay taxes on their interest income in accordance with their respective tax brackets. To ensure compliance with tax regulations, the fund houses deduct Tax Deducted at Source (TDS) from the interest payments distributed to investors. Moreover, the possibility of capital gains tax may arise in certain scenarios, and the fund will provide details on this in its quarterly reports and statements.