Office No. 106A, B-Wing Kanakia Wall Street,

Andheri - Kurla Rd, Chakala, Andheri East,

Mumbai, Maharashtra - 400093

Infrastructure Funds are pooled investments that focus on

financing public and private

infrastructure projects, such

as roads, bridges, water systems, and energy. These funds

typically offer investors exposure to long-term, income-

generating assets with stable cash

flows.

Infrastructure Funds provide an opportunity to invest in the

backbone of the economy. These

funds often come with

lower risks compared to other asset classes and offer steady,

inflation-protected returns. They also provide a tangible

impact, contributing to the

development and enhancement

of vital public services and facilities.

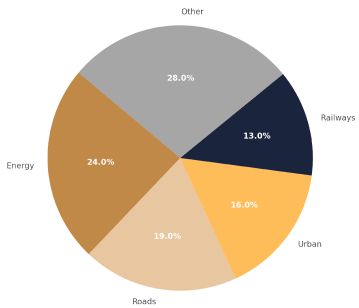

Projected Capital Expenditure in Infrastructure in India (2020-2025)

Source: IBEF and Mordor Intelligence

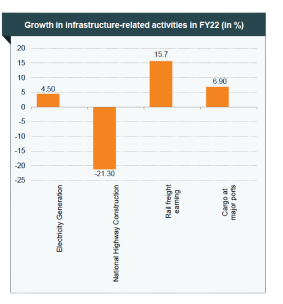

The infrastructure sector stands as a pivotal force in propelling the Indian economy, playing an essential role in the nation's comprehensive economic growth and development. It is poised to significantly contribute to India's ambition of reaching a USD 5-trillion economy.

The sector is forecasted to witness a compound annual growth rate (CAGR) of 8.2% by 2027. In line with these growth prospects, the Indian Government has committed substantial investments towards revitalizing the nation's aging infrastructure. These efforts are aimed at steering India towards self-sufficiency and expanding its share in the global export market.

The construction market in India is projected to attain a value of US$ 1.42 trillion by 2027. This growth trajectory is marked by an expected CAGR of 17.26% over the forecast period from 2022 to 2027.

Source: IBEF

As per SEBI Regulations, “Infrastructure fund” means an AIF which invests primarily in unlisted securities or partnership interest or listed debt or securitized debt instruments of investee companies or special purpose vehicles engaged in or formed for the purpose of operating, developing, or holding infrastructure projects.

Infrastructure funds are a Category I AIF that raises cash by aggregating assets from private participants and invests largely in businesses that create infrastructure projects. Infrastructure funds invest in the development of public infrastructure like roads, airport, renewable energy, water, railways, transmissions, and municipal solid waste. The Indian Government has incentives and concessions in order to encourage infrastructure funds, since they help positively impact the Indian economy.

Infrastructure Funds provide investors with steady and consistent returns, mainly because demand for infrastructural services remain constant, or are constantly on the rise, even when the country’s economic growth is slow. Compared with other investments, these funds potentially offer more security against volatile stocks, and hence better at risk-management.

Since Infrastructure Funds come under Category I, these are close-ended and come with a minimum tenure of more than three years, which could be extended by additional two years. Liquidate within a year of the fund's tenure ending.

The category I AIF are given pass-through status, whereby the responsibility for taxation shifts from the fund to the individual investor, even if the investor hasn't redeemed their investment. Investors are required to pay taxes on their interest income in accordance with their respective tax brackets. To ensure compliance with tax regulations, the fund houses deduct Tax Deducted at Source (TDS) from the interest payments distributed to investors. Moreover, the possibility of capital gains tax may arise in certain scenarios, and the fund will provide details on this in its quarterly reports and statements.

Sustained Focus: The Finance Minister's emphasis on inclusive development in the northeast and increased capital investment outlay signal a sustained commitment to infrastructure.

Opportunity for Private Investment: Budget initiatives, including the establishment of the Infrastructure Finance Secretariat, create opportunities for increased private investment in infrastructure.

Upcoming Assets for Sale: In the next four years, 400 small road assets and 300-400 solar assets are expected to come up for sale, presenting lucrative investment opportunities.

Investing in Indian infrastructure offers a unique blend of surging demand, government support, attractive opportunities, and a conducive policy environment, making it a compelling prospect for investors.

Robust Demand:

Attractive Opportunities:

Policy Support:

Increasing Investments:

Urban Indian Real Estate:

National Infrastructure Pipeline (NIP):

Government Initiatives: