Office No. 106A, B-Wing Kanakia Wall Street,

Andheri - Kurla Rd, Chakala, Andheri East,

Mumbai, Maharashtra - 400093

Global Private Credit Funds are investment vehicles that

specialize in providing debt

financing to companies

outside of traditional banking channels. These funds

often target

mid-sized companies, offering various debt

structures such as direct loans, mezzanine

financing,

distressed debt, and more.

Investing in Global Private Credit Funds can offer higher yields

compared to traditional

fixed-income investments, with the

added benefit of diversifying credit exposure. These

funds

play a critical role in financing businesses, often

accompanied by detailed

covenants and security provisions

that provide layers of protection for investors.

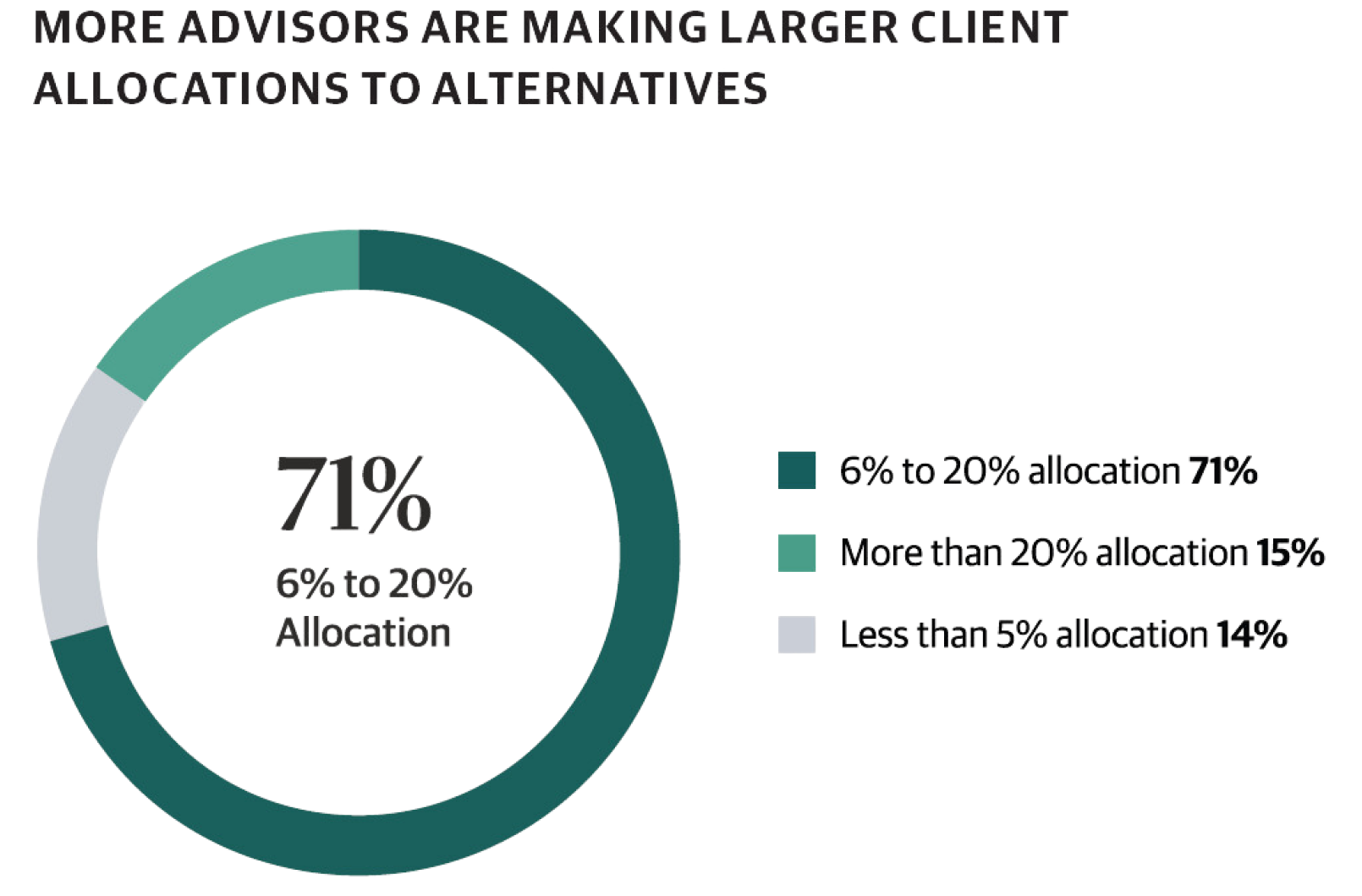

Global Private Credit Market Trends

Source: Blackstone - Advisor Trends in Private Markets 2023

Customized as per the requirement of user. Not a traditional form of bank loan.