Office No. 106A, B-Wing Kanakia Wall Street,

Andheri - Kurla Rd, Chakala, Andheri East,

Mumbai, Maharashtra - 400093

Hedge Funds are private investment funds that use

complex strategies and investments to generate returns

for their investors. They are known for their flexibility in

investment styles, leveraging a variety of financial

instruments, and often employing risk management

techniques to balance potential gains with downside

protection.

Investing in Hedge Funds offers the potential for higher

returns and risk-adjusted performance, independent of

market directions. Hedge Funds can provide portfolio

diversification and reduce overall volatility, thanks to their

unique strategies and ability to capitalize on short-term

market movements.

Hedge funds AUM as of September 2022.

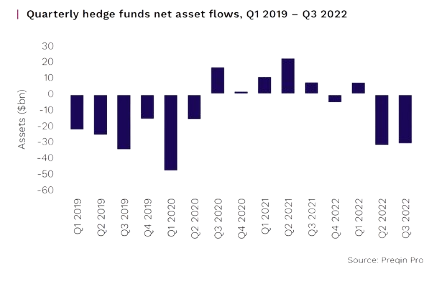

Industry net outflows in 2022 (as of September), marking a stressful year for managers.

Annualized* net return of hedge funds, compared with our 60/40 proxy portfolio, which declined 26.7% (20.8% as of September).

Annualized* net return of CTAs, the best-performing category within the industry. Macro hedge funds also climbed, returning +6.1% to investors.

Annualized* net return of equity hedge funds, the worst-performing top-level strategy.

Annualized* net return of commodities macro hedge funds, the best-performing sub-strategy.

Source: Prequin Data - Nov 2019

Hedge funds are private investment funds that use varied and complex strategies to invest in a wide range of assets. Unlike traditional mutual funds, they aim for higher returns and are typically accessible only to accredited investors due to their high-risk nature.

Hedge funds employ different strategies:

Hedge funds are a significant part of alternative investments, offering diversification due to their low correlation with traditional asset classes. They often use leverage and derivatives to enhance returns.

Allocating investments in hedge funds during economic uncertainties can provide several benefits:

Including a hedge fund in a portfolio can enhance its diversification, potentially improving risk-adjusted returns. However, investors should also be aware of the higher fees, risks, and illiquidity associated with hedge fund investments.

Historically, hedge funds have provided high returns, especially in volatile markets. However, their performance can be inconsistent, with periods of significant gains and losses.

Risk management is crucial for hedge funds. Strategies involve diversifying investments, using sophisticated algorithms for market predictions, and employing hedging techniques to mitigate losses.

Investing in hedge funds involves several risks:

To mitigate risks in hedge funds, investors can:

Hedge funds typically attract high-net-worth individuals, pension funds, and institutional investors, who can afford the high minimum investment requirements and are willing to take on greater risk.

Hedge funds are subject to regulations which vary by country. These regulations focus on investor protection, fraud prevention, and financial stability. Recent years have seen increased scrutiny and regulatory changes in many jurisdictions.

Current trends include increasing use of artificial intelligence and machine learning for investment strategies, a focus on sustainable and responsible investing, and adaptation to global economic changes.

The future of hedge funds seems to involve more integration of technology, a shift towards more transparent and investor-friendly practices, and adaptation to global economic and regulatory changes.

When allocating money to hedge funds, investors should typically consider a long-term investment horizon. This is often suggested to be at least 3 to 5 years. The reason for this is that hedge funds often employ complex strategies that require time to mature and bear fruit.

Additionally, many hedge funds have lock-up periods where investors cannot withdraw their funds for a certain period, aligning with the need for a longer-term perspective. This timeframe allows the hedge fund strategies to navigate through different market cycles and adjust to changing economic conditions.

Hedge fund fee structures typically include two main components: a management fee and a performance fee.

The classic structure is often referred to as "2 and 20", meaning a 2% management fee and a 20% performance fee, although these rates can vary. Some funds may also implement high-water marks or hurdle rates to ensure performance fees are only charged on genuine profit generation.

Hedge funds employ a variety of strategies, each with its own risk and return profiles:

Each strategy carries unique risks and requires different skill sets from the fund managers. Investors should choose a strategy that aligns with their risk tolerance and investment goals.

Hedge funds have emerged as a resilient option in the face of market fluctuations, notably offering crucial downside protection. In periods of market downturns, like September 2023, while global equities fell significantly, hedge fund strategies such as relative value and macro, alongside emerging niche areas like cryptocurrency and Insurance-Linked Securities (ILS), have shown their strength in preserving capital. The AUM for these niche strategies saw a remarkable increase from $41.4bn to $86.1bn by September 2023, highlighting their growing appeal among investors seeking diversification away from traditional assets. Overall, hedge fund AUM reached a record $4.4 trillion in September 2023, with this growth attributed more to asset returns than to new investor inflows.

Source: Preqin