Office No. 106A, B-Wing Kanakia Wall Street,

Andheri - Kurla Rd, Chakala, Andheri East,

Mumbai, Maharashtra - 400093

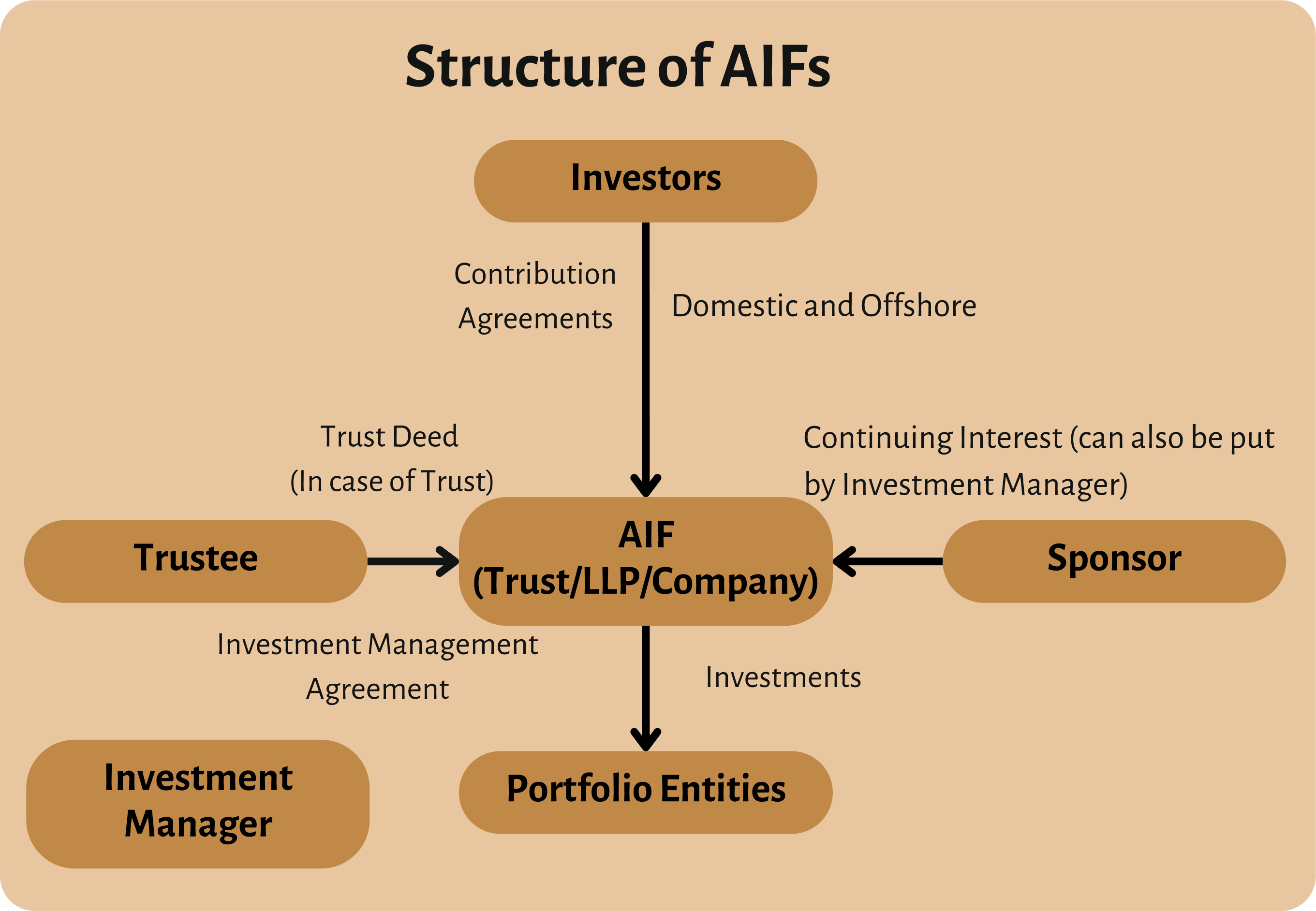

Alternative Investment Funds (AIFs) in India are investment vehicles that collect money from sophisticated private investors, both Indian and foreign, to invest it according to a stated investment strategy.

Unlike mutual funds or exchange-traded funds (ETFs), which typically invest in public equities or fixed-income securities, AIFs often focus on alternatives like venture capital, private equity, hedge funds, and managed futures. These funds are seen as important for the growth of the Indian economy as they can provide the necessary capital for startups and other sectors that do not have easy access to traditional forms of finance.

Any investor whether Indian, foreign, or non-resident Indian can invest in an AIF, as long as she/he has the required funds for investment, and is willing to take a risk on the unlisted and illiquid securities. To invest in an AIF investor must provide proof of income, PAN card, and ID proof.

All AIF categories in India except "angel fund" need a minimum investment of Rs. 1 crore, whereas, for the angel fund, that amount is Rs. 25 lakhs. In the case of an employee or director of AIF, the minimum value of investment shall be Rs. 25 lakhs.

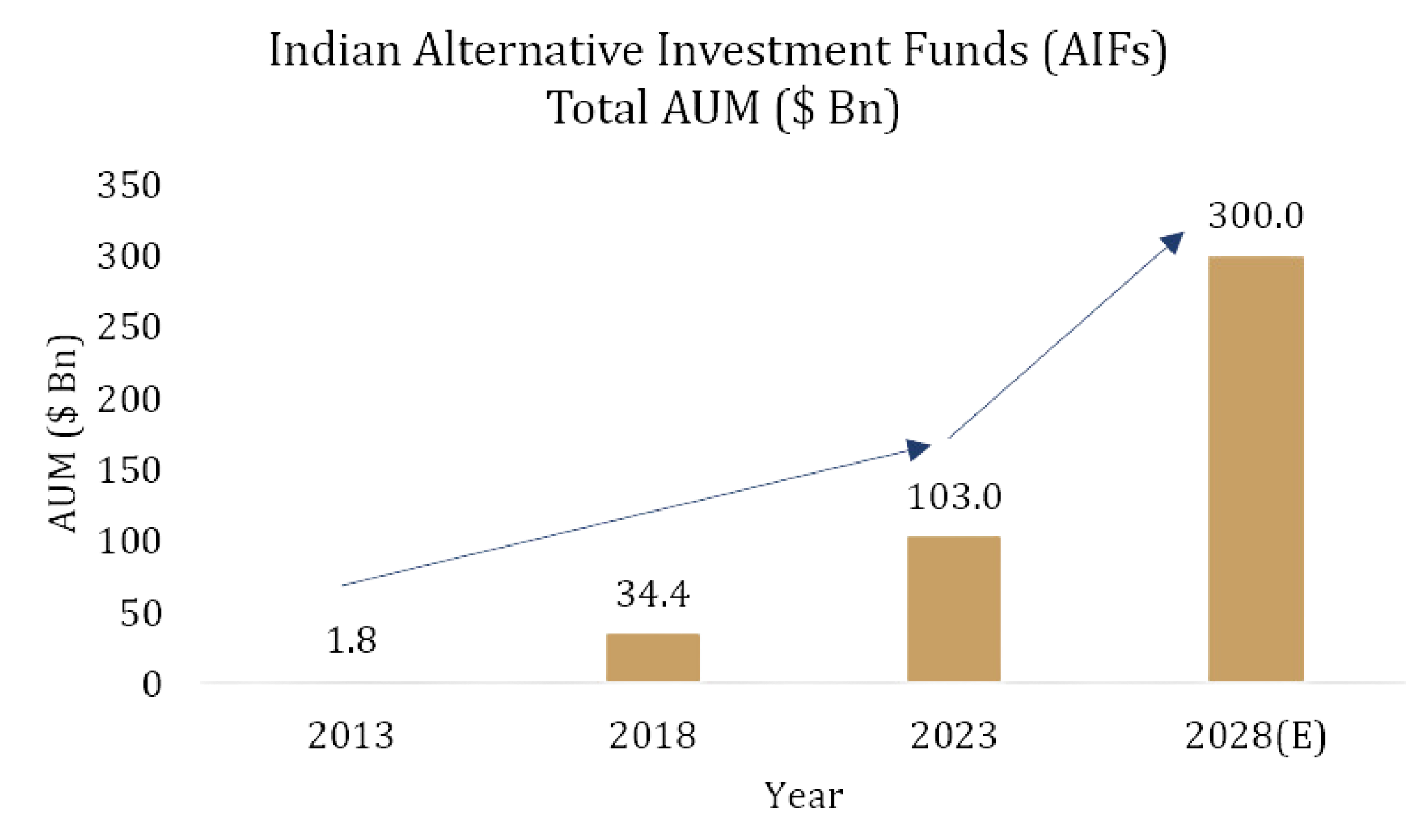

The following factors have contributed to the growth of AIF markets in India:

Alternative Investment Funds offer a higher degree of flexibility than mutual funds as they invest in unlisted shares and also use shorting and leverage

For HNIs who are looking to diversify their portfolios and increase long-term returns on their investments while willing to take a considerable risk, AIFs seem like decent investment alternatives. But for those who can take low to high risk, mutual funds are the way to go. The decision between alternative investment funds and mutual funds should be based on your investment objectives, available capital, and long-term intentions.

In Portfolio Management System (PMS), each investor portfolio is different, and it’s a customized offering. PMS cannot pool money from different investors to create an investment fund. PMS investors can also choose to exit their investments anytime they want. On the other hand, AIFs pool money from investors and have a lock-in period ranging from 3 to 5 years.

AIFs are classified into three categories based on their investment strategies and risk profiles:

Since the categories are different with different investment vehicles, the tax implications are also different for each of them. Let us see the tax implication for each of them

When it comes to taxation, Category I and II AIFs have a pass-through status. This means that any income (except for business income) that the fund generates, is taxed to the investor and not to the fund house - even if the investor has not redeemed the investment. The investors need to pay taxes according to their respective tax slabs.

Therefore, if you invest in category I and II AIF, you need to pay capital gain tax on the profit or loss you make from the AIF funds within a given duration. The duration here is important to understand whether long-term capital gain tax or short-term capital gain tax would be applied. As per the recent rules for LTCG, 20% is the rate of tax with indexation benefit. If the profits are taxed as STCG, then the rate would be 15%. There is a surcharge, and cess charges on and above the mentioned tax rates as well. Any income (except business income) distributed by the investment fund is not liable for DDT and TDS of 10% will be deducted by the investment fund. It is to be noted that in Category I and II, the investor needs to pay advance tax during the year.

| Natural of Income Earned by the Fund | Taxability | Tax Rate |

|---|---|---|

| Other than business income ( For example capital gains ) | Passed through - AIF does not pay any tax. The unit holder pays the tax | Rates applicable to the unit holder |

| Business Income | Taxed at AIF. Such income is not taxable for unit holder | AIF was formed as a company or LLP. Taxed at the rates applicable to the company or the LLP.

AIF formet as Trust: Taxed at Maximum Marginal Rate*. |

Unlike Category I and II, there is no pass-through status for Category III. This category is taxable at the fund level. The business income of Category III AIFs are taxable at the highest income tax slab level (42.7%) at the fund level. The returns given to investors are after deducting the tax. The different sources of income in category III AIF are taxed in the following manner

| Tax type | Short-Term Capital Gains | Long-Term Capital Gains | Business Income | Dividend Income |

|---|---|---|---|---|

| Basic tax | 15% | 10% | 30% | 30% |

| Surcharge over tax | 15% | 15% | 37% | 37% |

| Education Cess | 4% | 4% | 4% | 4% |

| MMR | 17.94% | 11.96% | 42.74% | 42.74% |

Disclaimer: However, it is advisable to consult your individual tax advisor and keep track of regulatory changes